Crack the Crypto Code: Your Essential Guide to Indicators

The crypto world can feel like a rollercoaster, but indicators are your secret weapon! These handy tools help you spot trends and make smarter trades, even when the market's going wild.

Why Indicators Are Your Crypto BFFs

Think of indicators like your trusty sidekick in the crypto world. They use past price and volume data to give you a sneak peek into the market's future moves. This helps you:

- See the Big Picture: Get a feel for the overall market vibe – is it time to buy, sell, or just chill?

- Time Your Moves: Spot the perfect moments to jump in or cash out, boosting your profit potential

- Double-Check Your Gut: Combine indicators to confirm your trading hunches and avoid those impulsive trades

- Stay Safe: Some indicators act like a safety net, helping you manage risk and protect your investments

The A-List Indicators

Let's meet a few of the crypto trading all-stars:

- Moving Averages (MA): These smooth out the price chart, showing you the average price over time. Use them to spot trends and potential buy/sell signals.

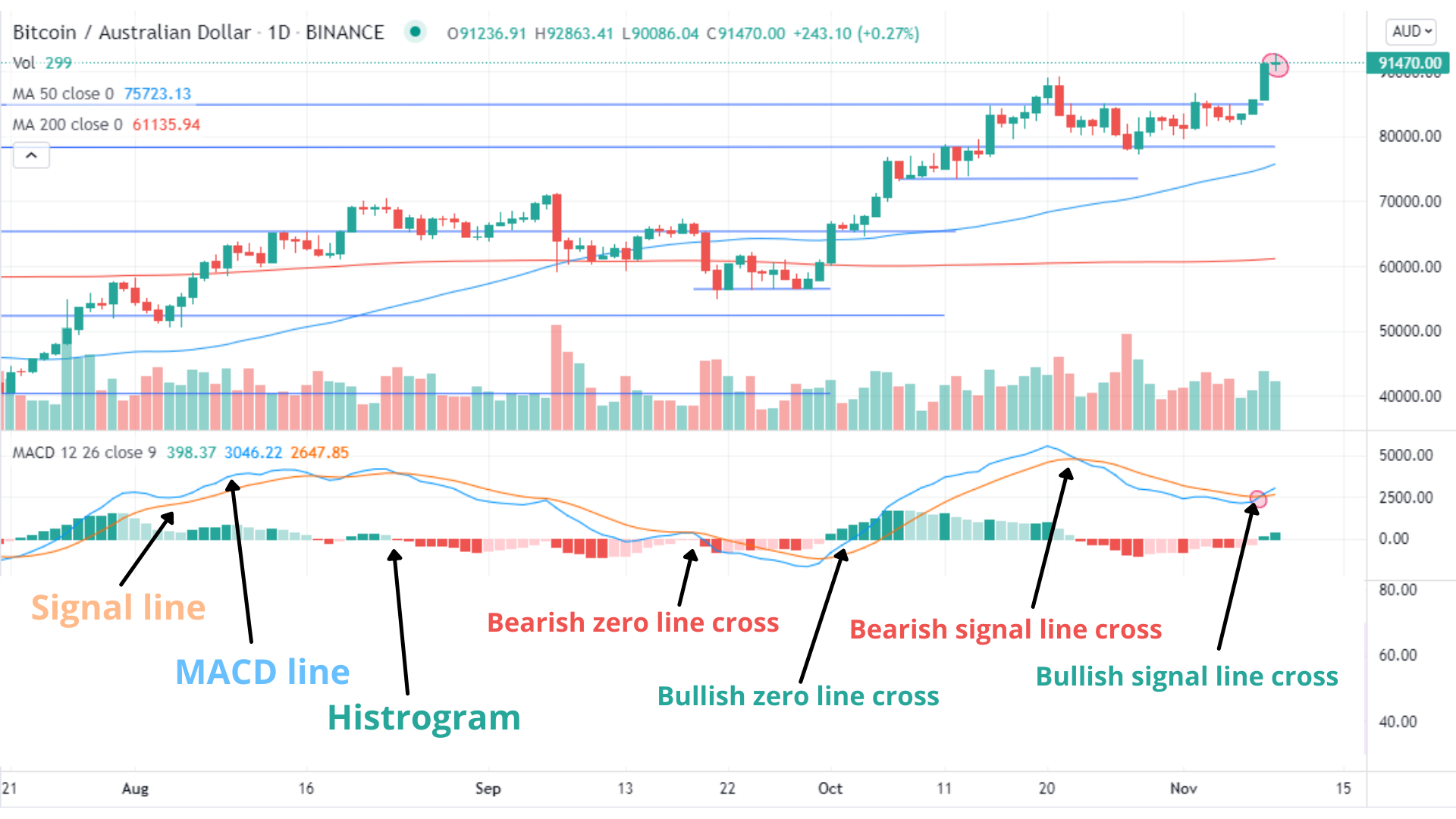

- MACD (Moving Average Convergence Divergence): This one's like a momentum meter, tracking the relationship between two moving averages. It can also give you a heads-up on when to buy or sell

- RSI (Relative Strength Index): This measures how strong a price move is. High values might mean it's time to take some profits, while low values could signal a bargain

Indicators in Action

Let's say you're checking out Bitcoin:

- Moving Averages: Use a 50-day and 200-day MA. If the price crosses above both, it's looking bullish! If it drops below, it might be time to rethink your strategy

- MACD: Watch for the MACD line crossing the signal line. Crossing above is usually a buy signal, crossing below a sell signal

- RSI: Keep an eye on the RSI value. Above 70? Things might be getting a bit too hot. Below 30? It could be a cool buying opportunity

Picking Your Indicator Power Team

- Short-term trader? Go for fast-reacting indicators like RSI

- Long-term investor? MA and MACD are your go-to tools

- Remember: No single indicator is a crystal ball. Combine a few to get a clearer picture

- Don't forget the fundamentals! Indicators are just one part of the equation. Keep an eye on news and project developments too

Ready to Level Up Your Trading Game?

Indicators are powerful allies, but practice makes perfect. Keep learning, experimenting, and consider all the factors before making any investment decisions.

Start your crypto journey with confidence at Coins.co.th

Ready to put your knowledge into action? Sign up and start trading on Coins.co.th today for a user-friendly and secure crypto experience.