Thailand is actively positioning itself as a regional Crypto Hub, and a key financial innovation underscoring this ambition is the "G-Token" (Government Token). This is not a new cryptocurrency but rather a government-issued digital token designed for investment, aiming to provide a novel fundraising avenue for the state and broaden public access to digital asset investments.

Understanding G-Token: Technical and Legal Framework

Issued by Thailand's Ministry of Finance, the G-Token is classified as a debt instrument. Holders of G-Tokens are entitled to the return of principal and predefined returns, as specified by the Ministry of Finance, similar to investing in government bonds. However, G-Tokens will leverage blockchain or Distributed Ledger Technology (DLT) for recording and managing beneficial rights, marking an innovative approach to public debt management under the Public Debt Management Act B.E. 2548 (2005).

Crucially, G-Tokens are not intended or supported for use as a Means of Payment (MOP) for goods and services. This policy is clearly articulated by both the Securities and Exchange Commission (SEC) Thailand and the Bank of Thailand (BOT).

Accessing and Investing in G-Tokens

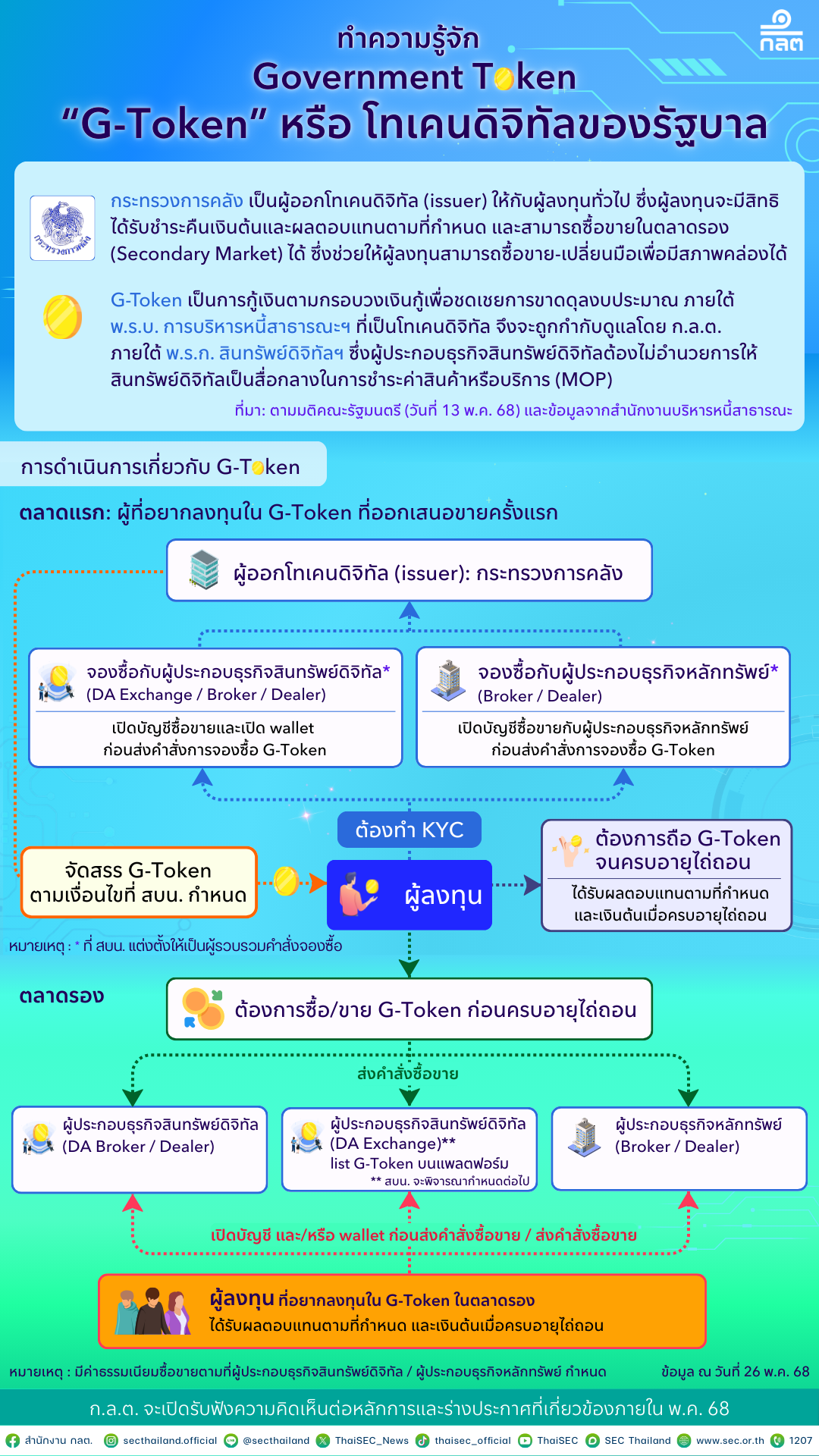

According to guidelines released by the SEC Thailand, the public and investors will be able to access G-Tokens through the following channels:

- Primary Market: Subscribing to G-Tokens directly from the issuer (Ministry of Finance) via licensed digital asset business operators (e.g., digital asset exchanges, brokers/dealers) and securities firms.

- Secondary Market: Trading G-Tokens after they are listed on licensed digital asset exchanges.

To facilitate this and promote liquidity, the SEC has established relevant rules, including:

- Exemption from Additional Licensing: Existing licensed digital asset business operators do not need to obtain new licenses specifically for providing G-Token related services.

- Permission for Securities Firms: Securities firms licensed under the Securities and Exchange Act are permitted to offer G-Token services without requiring an additional digital asset business license.

Investors are always advised to thoroughly study the G-Token's White Paper and official announcements from relevant authorities before making any investment decisions.

Role of G-Token in Market Development and Financial Inclusion

G-Token is more than just a new government fundraising tool; it plays a significant role in:

- Promoting Digital Financial Literacy: Serving as an "entry point" for the general public, especially retail and novice investors, to learn about and gain experience with digital asset investments through a government-issued product with perceivable and understandable risk.

- Expanding Investment Options: Introducing a new investment product that combines the perceived security of government debt instruments with the innovation of digital technology.

- Stimulating the Digital Asset Market: The introduction of G-Tokens could increase trading volume and user engagement within Thailand's broader digital asset ecosystem.

Current Status and Regulatory Outlook (As of early June 2025)

- Cabinet Resolution: On May 13, 2025, the Thai Cabinet approved the Ministry of Finance's plan to issue and manage G-Tokens.

- SEC Thailand's Actions: The SEC Board approved the principles for G-Token regulations (between March-May 2025). Subsequently, the SEC Office conducted a public consultation on six draft notifications related to G-Tokens (Hearing Document No. SorNor. 17/2568), which concluded on June 10, 2025.

The G-Token represents a significant development in Thailand's financial landscape. It addresses the government's need for efficient fundraising while offering investors access to novel, state-backed investment alternatives. The emergence of G-Tokens is poised to be another catalyst in Thailand's journey towards becoming a leading hub for digital financial innovation in the region.