Have you ever felt like you're playing a rigged game in the crypto market? You buy into a rally, only for the price to plummet. You sell in fear, only to watch it surge moments later. Meanwhile, massive investors known as "Whales" seem to time every move perfectly, reaping enormous profits.

This feeling isn't just in your head. Some waves in the crypto ocean are engineered, and behind them are often these large players. This article dives deep into groundbreaking research from the Federal Reserve Bank of Philadelphia to decode the whale's playbook and provides actionable strategies to help retail investors navigate these treacherous waters safely.

The Data Doesn't Lie: What Fed Research Revealed About Whales vs Retail

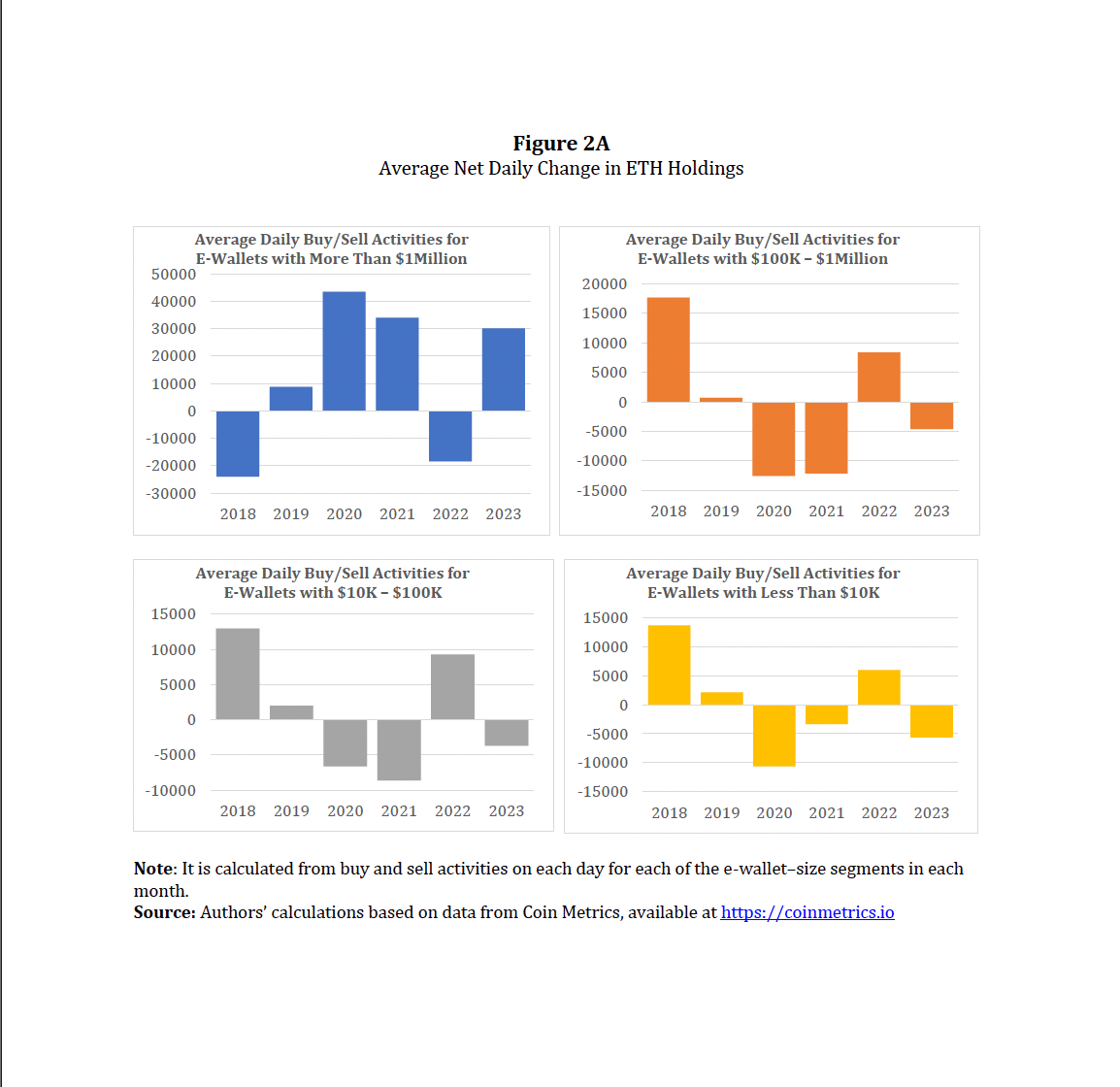

Researchers analyzed detailed Ethereum (ETH) transaction data from 2018 to 2023 to answer the critical questions on every investor's mind. The findings are stunning.

✍🏻 Whales Buy... Then the Price Rises

The study found that the largest investors (holding over $1M in ETH), or "Whales" 🐋, tend to significantly increase their ETH holdings right before a price increase. Specifically, for every 1% increase in holdings by this group, the price of ETH was correlated with a 0.6263% increase the following day.

✍🏻 Minnows Sell... Then the Price Rises

Conversely, the smallest retail investors (holding less than $10,000), or "Minnows" 🐟, showed a tendency to decrease their holdings (sell) just before a price increase. Even more alarmingly, when this group did buy, a 1% increase in their holdings was correlated with a 1.8223% price decrease the next day.

🤔 Who Really Drives Volatility?

Surprisingly, the research indicates that ETH price volatility is driven more by the trading activities of retail investors than by whales. The tendency of smaller investors to follow the herd—buying into rallies and selling into dips—creates the market's "choppy waters." Whale holdings, in contrast, often move against this volatility.

Hard Lessons from Real-World Events (Case Studies 2024-2025)

These patterns become even clearer when looking at real-world examples of whale manipulation:

Case Study 1: The $TRUMP Meme Coin Pump and Dump (Jan 2025)

- The Event: The $TRUMP meme coin surged over 300% after being hyped. However, over 80% of the supply was held by a few insider wallets. They sold at the peak, causing a collapse that erased over $2 billion in value for retail traders.

- The Lesson: Holder concentration is a massive red flag. Always check on-chain distribution before investing, especially in meme coins.

Case Study 2: The Polymarket Vote Hijack (Mar 2025)

- The Event: A whale used millions of governance tokens to manipulate the outcome of a prediction market, ensuring a result that profited their own bets.

- The Lesson: Decentralized governance is only as fair as its power distribution.

How to Defend Against the Whale's Game

While you may be outsized, you don't have to be outplayed. Learning to read the game and using the right tools is your best defense.

1. Spot the Danger Signs:

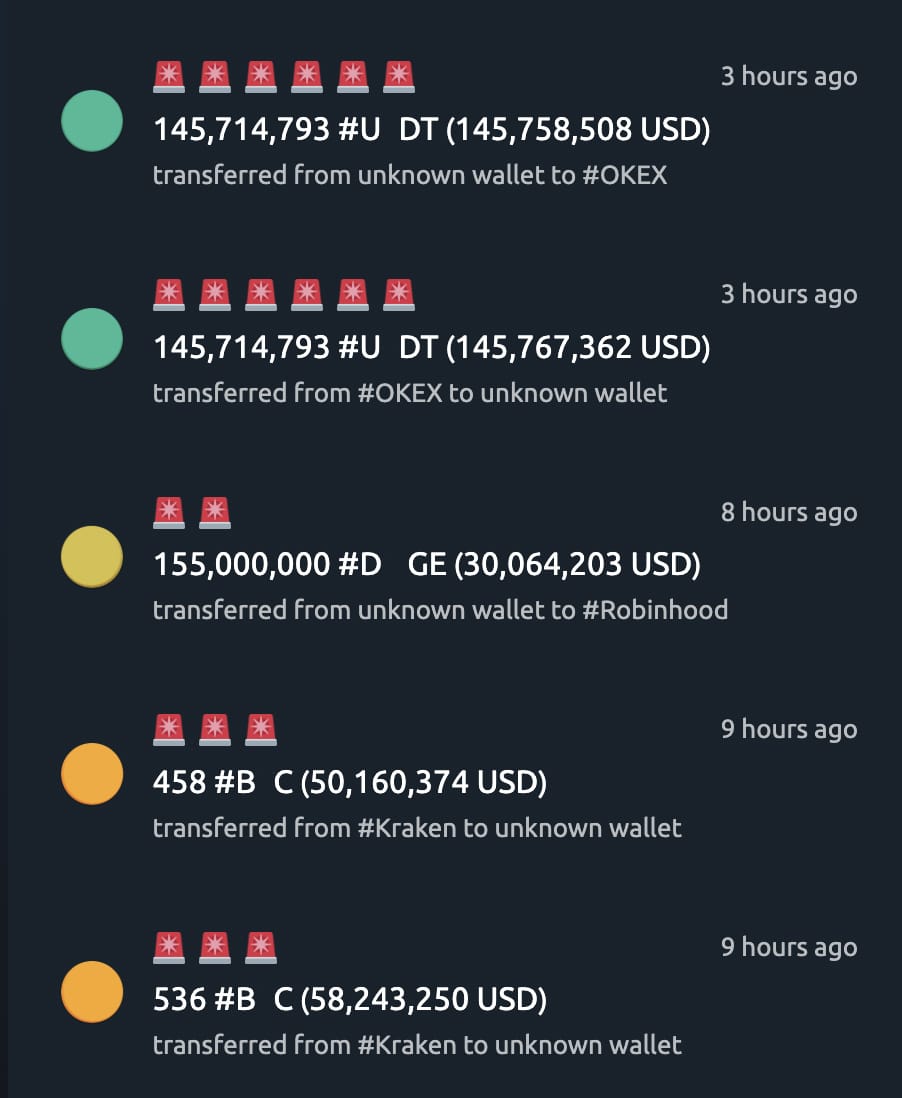

- Study Whale Behavior: Use on-chain analytics tools to monitor large wallets. A significant transfer to an exchange can be a prelude to selling for example: https://whale-alert.io/

- Don't Chase the Hype: As the data shows, the herd behavior of retail investors often leads to buying high and selling low. Avoid making emotional decisions based on market noise.

2. Armor-Plate Your Portfolio:

- Avoid Low-Liquidity Pools: These are the easiest markets for whales to manipulate.

- Limit Your Leverage: High leverage is a whale's playground, as they can more easily trigger mass liquidations.

- Diversify Your Holdings: Never go all-in on a single project, particularly one dominated by a few large wallets.

Swimming with Whales Without Getting Eaten

Whales will always be a part of the crypto ecosystem. Instead of fearing them, we can learn from them. The Fed's research provides a clear mirror reflecting the market's inner workings. By understanding these dynamics, leveraging the transparency of the blockchain, and practicing disciplined risk management, retail investors can not only survive but thrive in the long run.

.

.

.

.

.

Chernoff, Alan, and Julapa Jagtiani. (2024). “Beneath the Crypto Currents: The Hidden Effect of Crypto ‘Whales’.” Working Paper 24-14. Federal Reserve Bank of Philadelphia. Retrieved from https://www.philadelphiafed.org/-/media/frbp/assets/working-papers/2024/wp24-14.pdf